Lets Get Started

Welcome to the world of elevated banking

How would you like to start your financial fitness journey?

This is the first step towards an elevated banking experience. We are here to help you attain the goals you have set for yourself. Are you ready?

Elevate your financial experience

Read our articles to help you get started on your banking journey.

Licensed by the BSP,

Member of PDIC

UNO Digital Bank is one of the six digital banks licensed by Bangko Sentral ng Pilipinas. Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P500,000 per depositor.

Our

Headquarters

We are located at 20/F Unit 2001, The Finance Centre, 26th Street corner 9th Avenue, Bonifacio Global City, Taguig City 1635, Philippines

Bank

24/7

With UNO Digital Bank’s accessibility, we’re ready to attend to your queries and concerns 24/7*.

*We’re here to help you! Our customer happiness specialists are available from 6am to 10pm, 7 days a week

Free

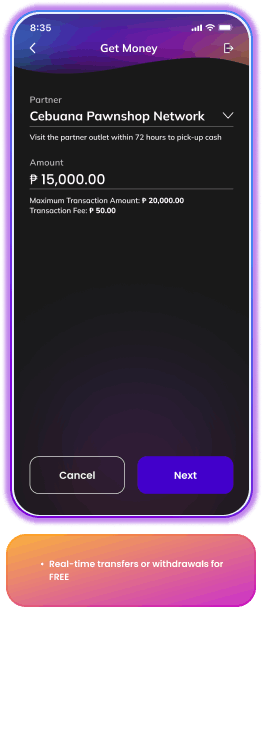

Cash In

Cash in for free at 7,500+ outlets and cash out at 4,500+ outlets nationwide.

Hi there!

We are UNO Digital Bank.

Manage your money and maximize its potential growth with a secure and trusted bank that fits right in your pocket.

NEW

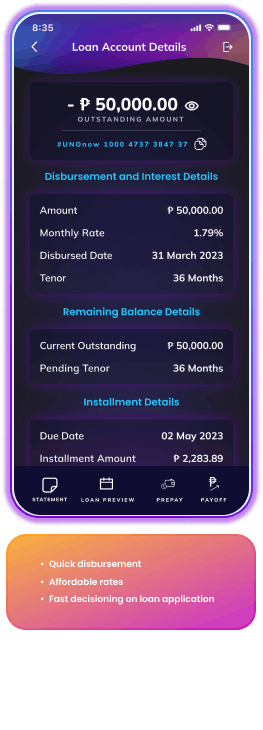

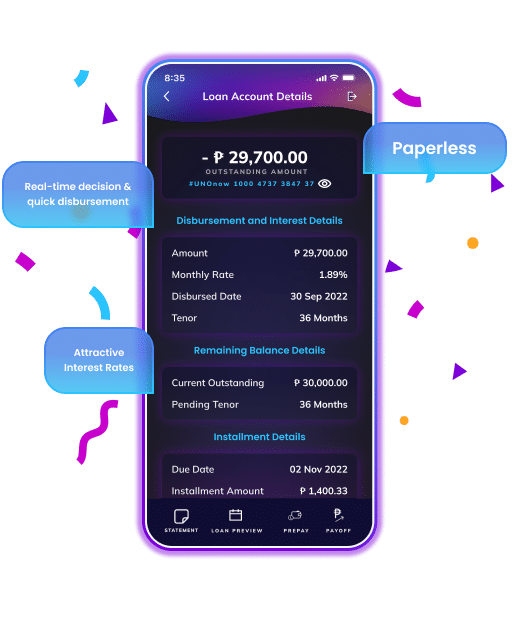

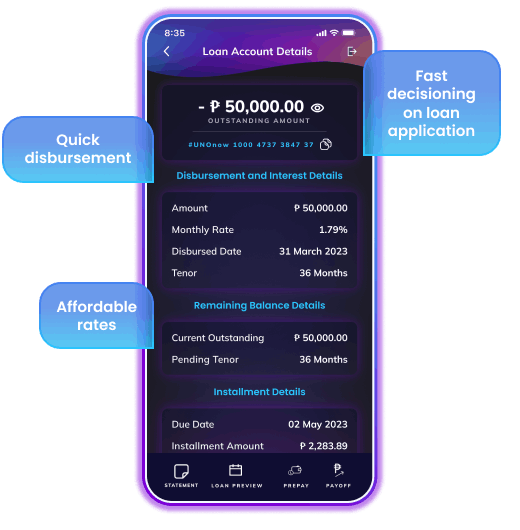

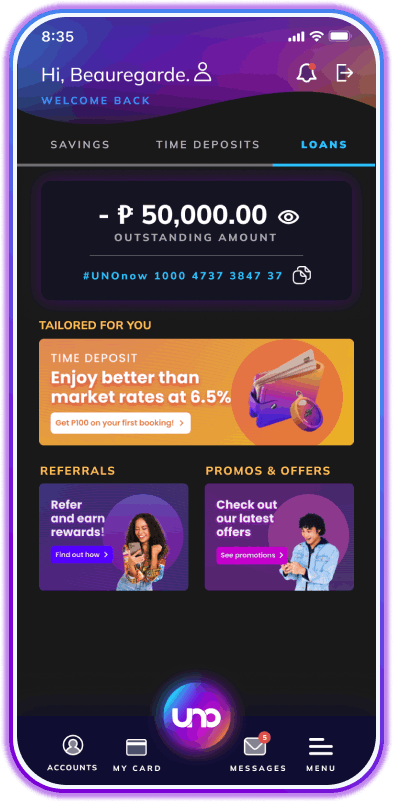

#UNOnow

Loan up to PHP 200,000 with #UNOnow without the need for collateral! Plus, you have the option of monthly installment payments for up to 36 months.

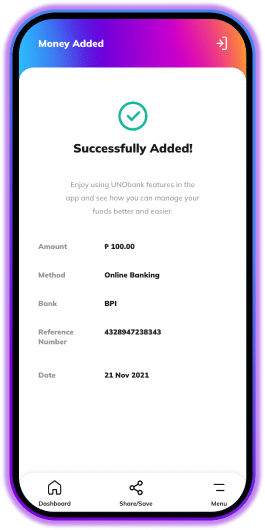

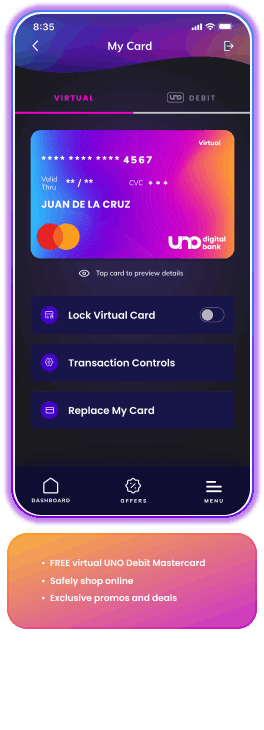

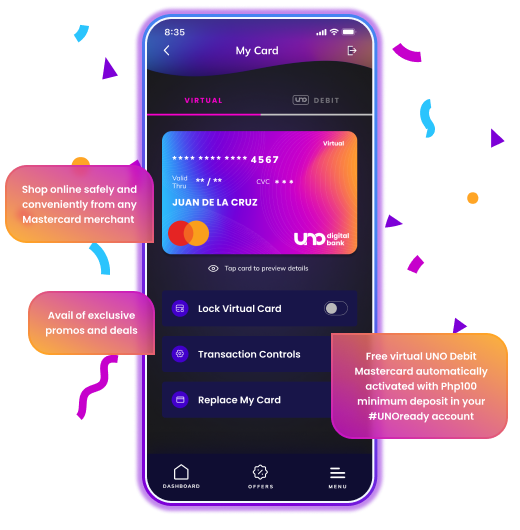

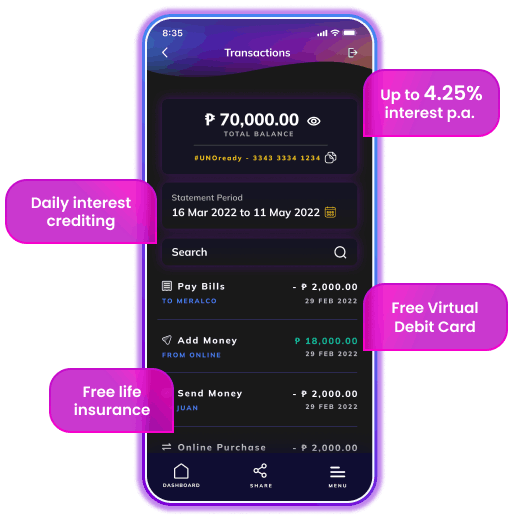

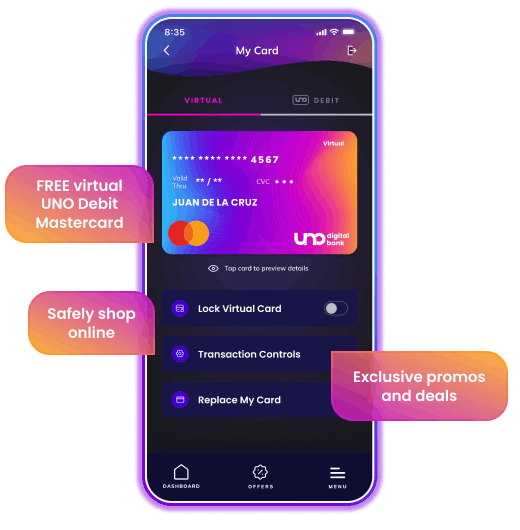

Get your Virtual Card

You are safe with UNO! Securely shop online in all Mastercard-accepting merchants worldwide!

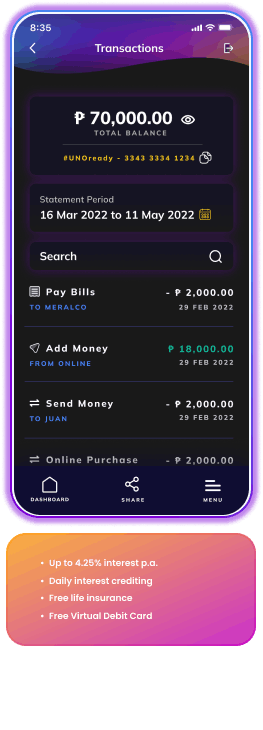

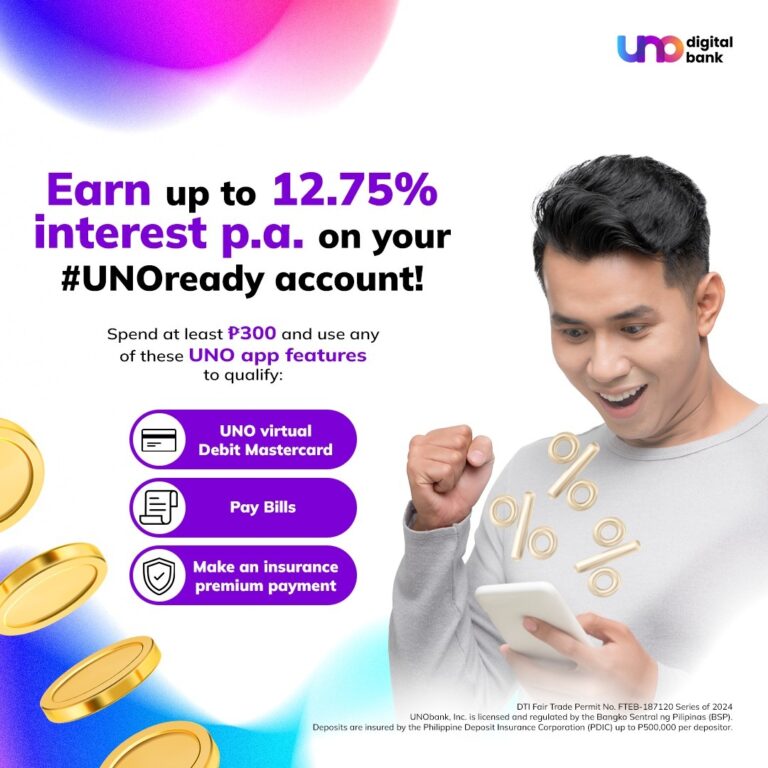

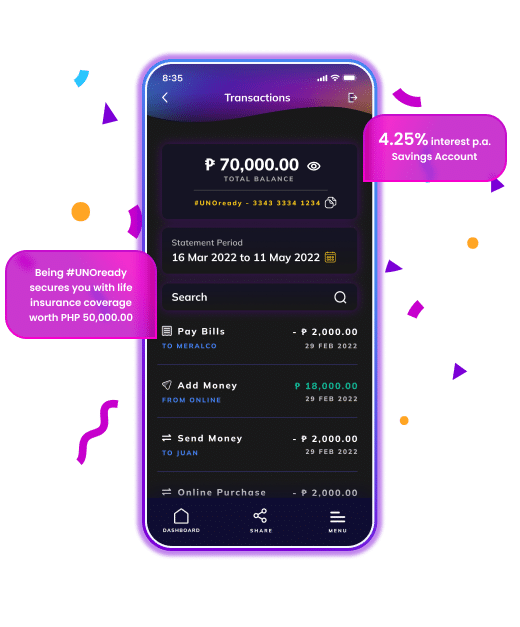

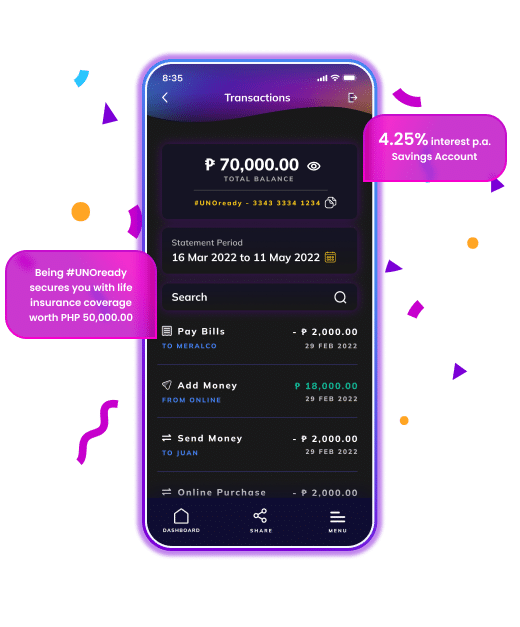

#UNOready

Elevate our earnings with free life insurance and an interest rate of up to 4.25% p.a. credited daily with our #UNOready savings account.

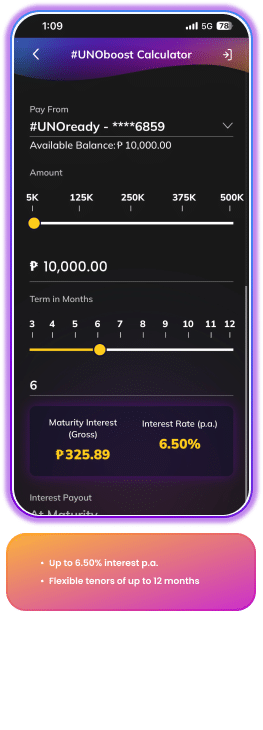

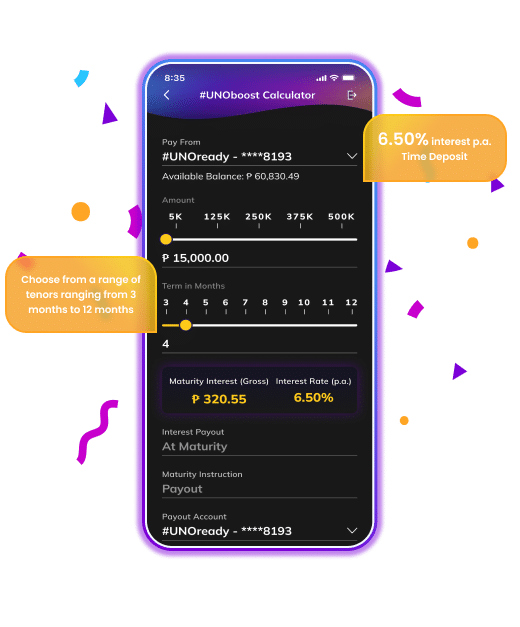

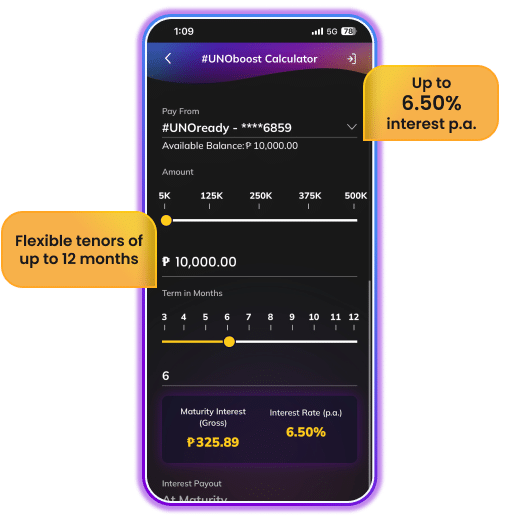

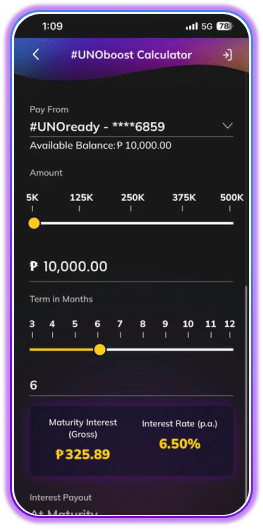

#UNOboost

Watch your money grow with up to 6.50% interest p.a. and flexible tenors with our #UNOboost time deposit!

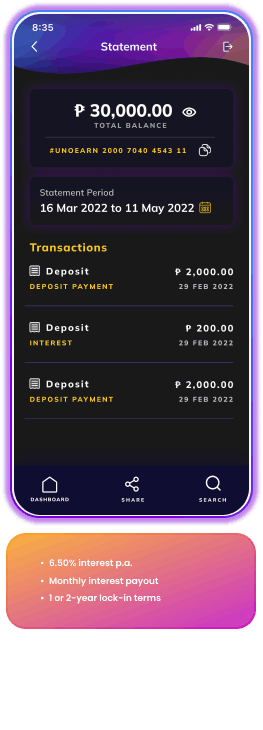

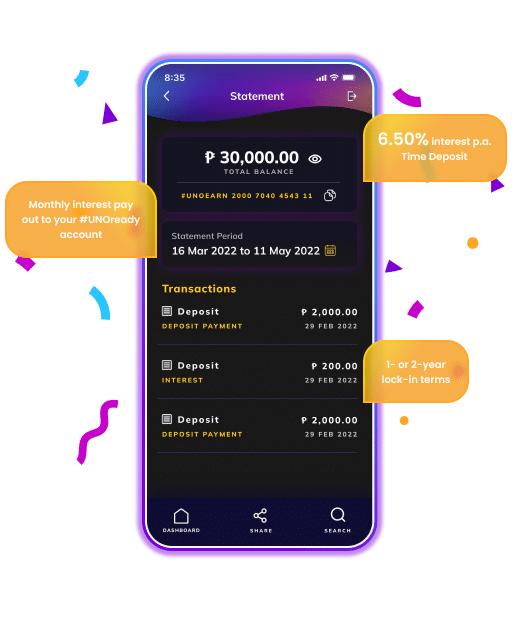

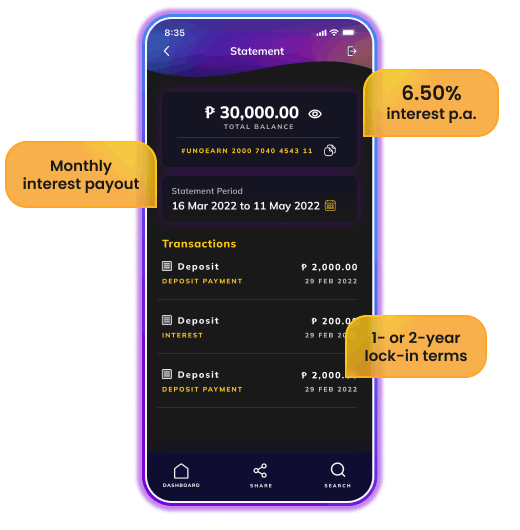

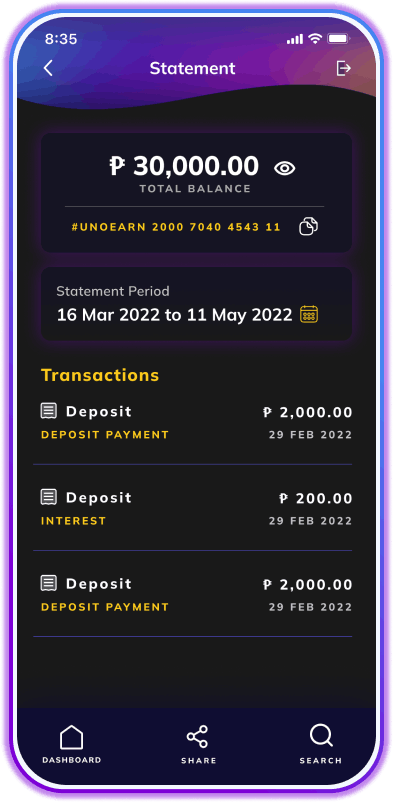

#UNOearn

Get monthly payouts and earn 6.50% p.a. interest rate with our #UNOearn time deposit!

Get your Virtual Card

You are safe with UNO! Securely shop online in all Mastercard-accepting merchants worldwide!

Hi there!

We are UNO

Digital Bank.

Manage your money and maximize its potential growth with a secure and trusted bank that fits right in your pocket.

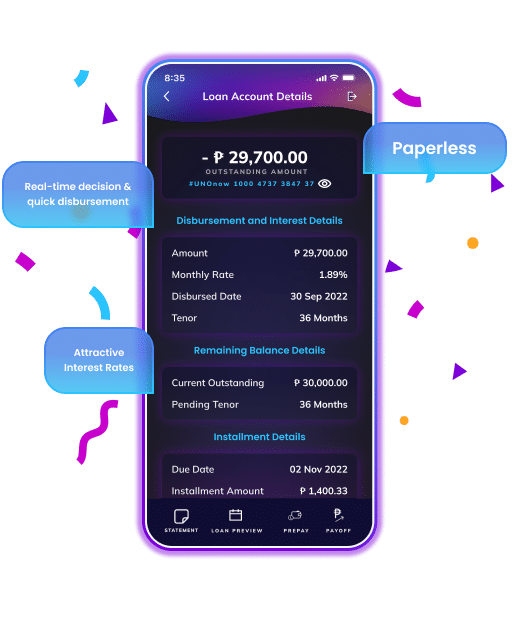

#UNOnow

Loan up to PHP 200,000 with #UNOnow without the need for collateral! Plus, you have the option of monthly installment payments for up to 36 months.

Get your

Virtual Card

You are safe with UNO! Securely shop online in all Mastercard-accepting merchants worldwide!

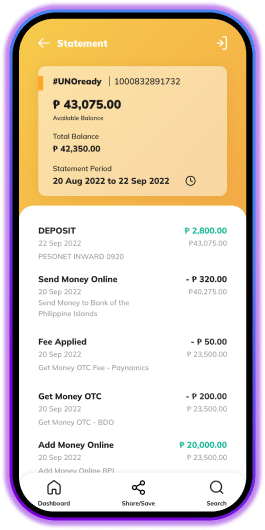

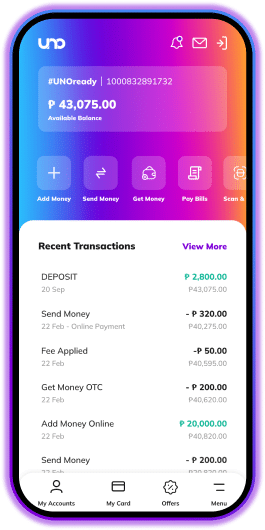

#UNOready

Elevate your earnings for up to 4.25% interest rate with our #UNOready savings account!

#UNOboost

Watch your money grow with 6.50% interest rate with our #UNOboost time deposit!

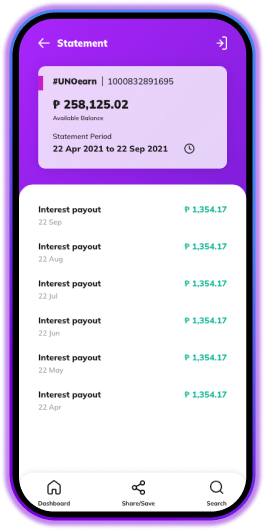

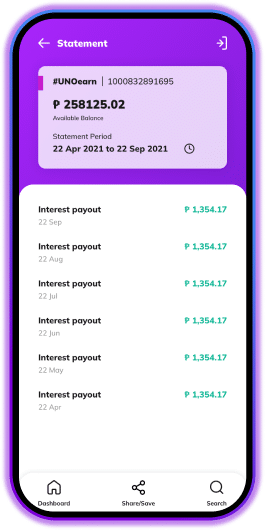

#UNOearn

Get monthly payouts and earn 6.50% interest rate with our #UNOearn time deposit!

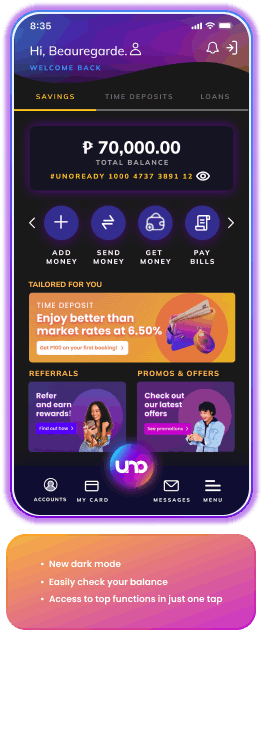

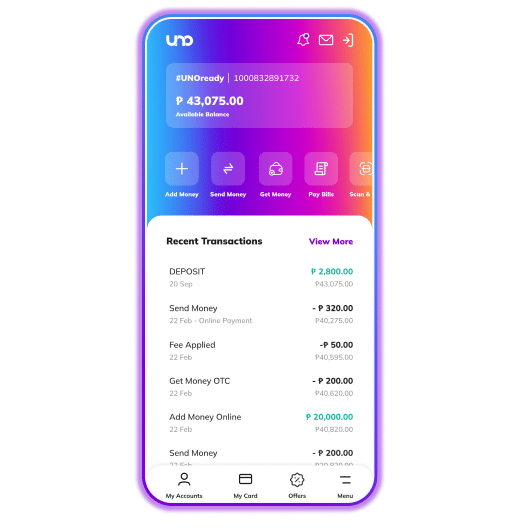

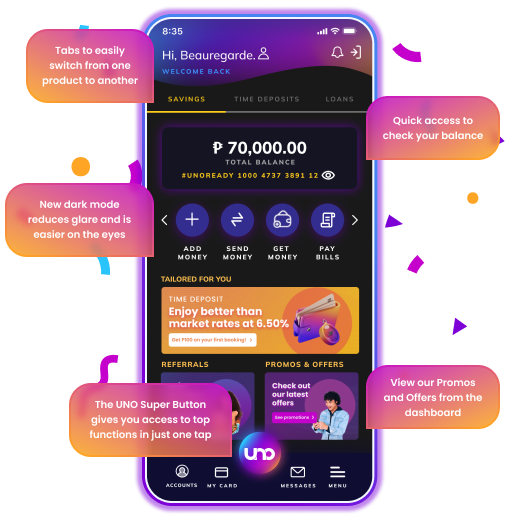

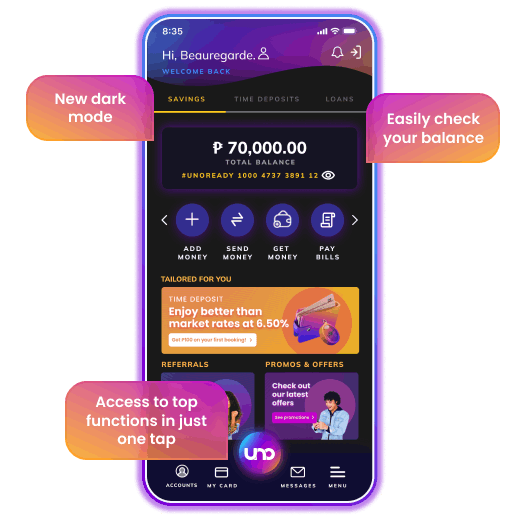

Get a personalized and elevated banking experience with our awesome features!

Get a personalized and elevated banking experience with our awesome features!

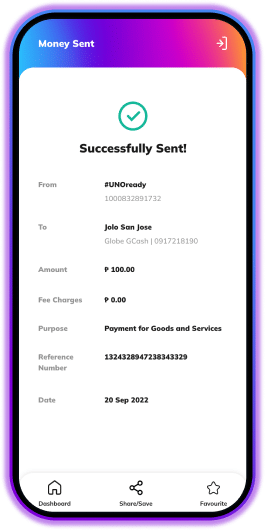

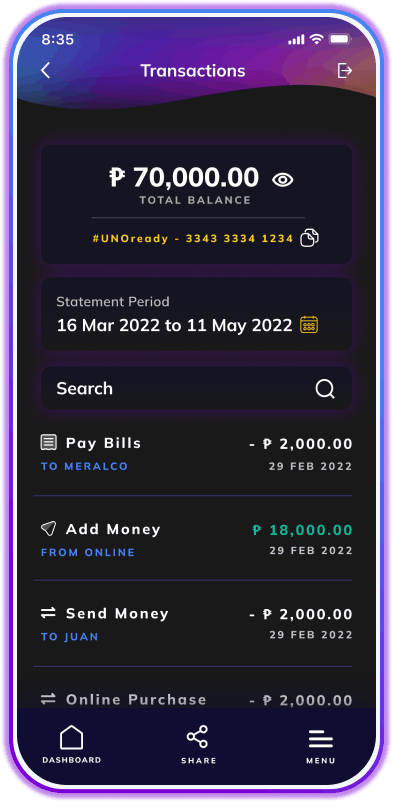

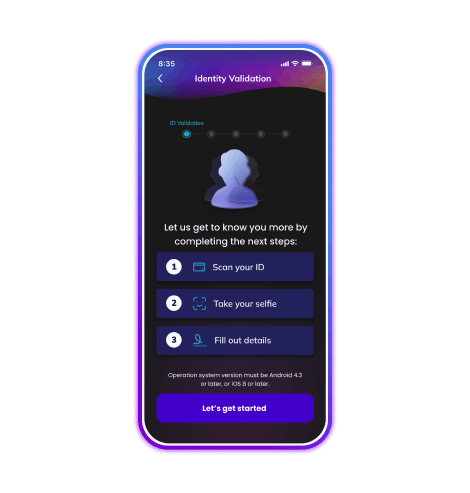

Bank conveniently anytime, anywhere.

Easily open an account in less than 5 minutes and be able to transact from wherever you are!

Easily open an account in less than 5 minutes and be able to transact from wherever you are!

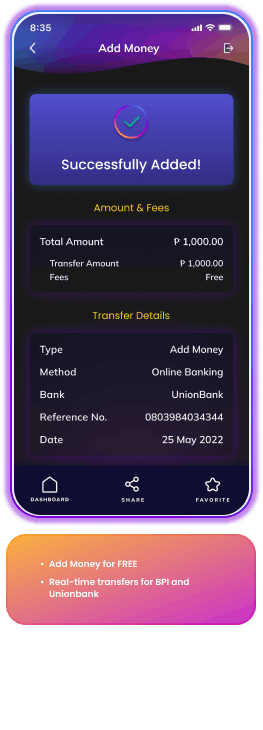

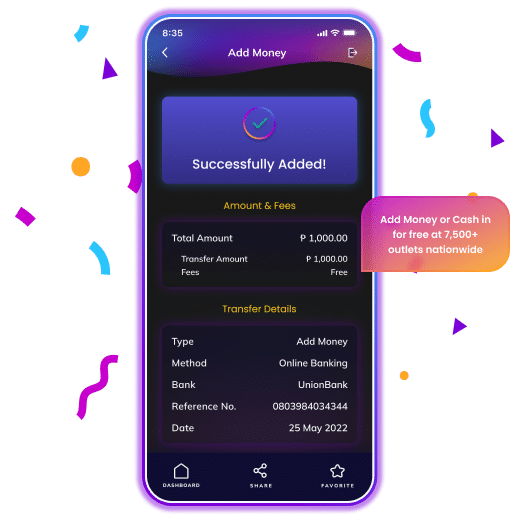

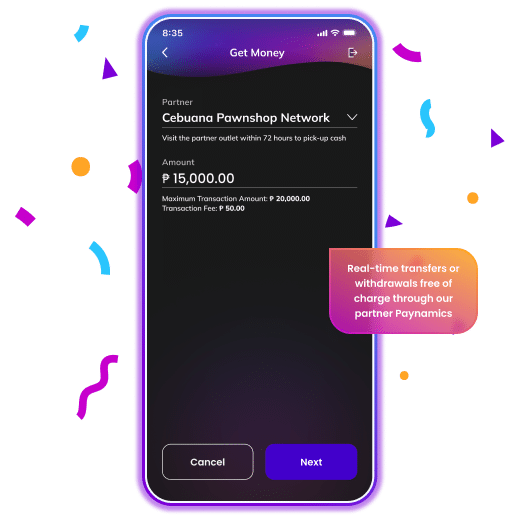

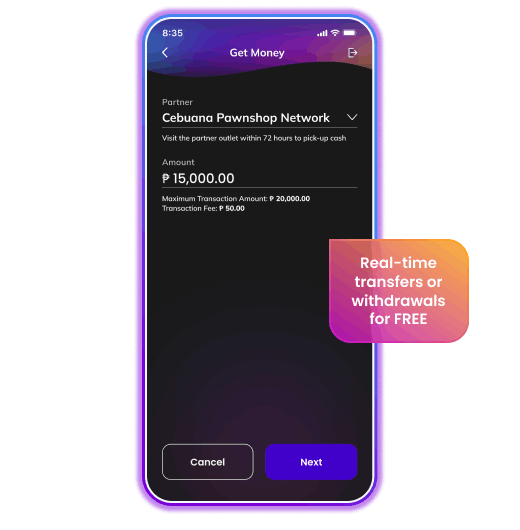

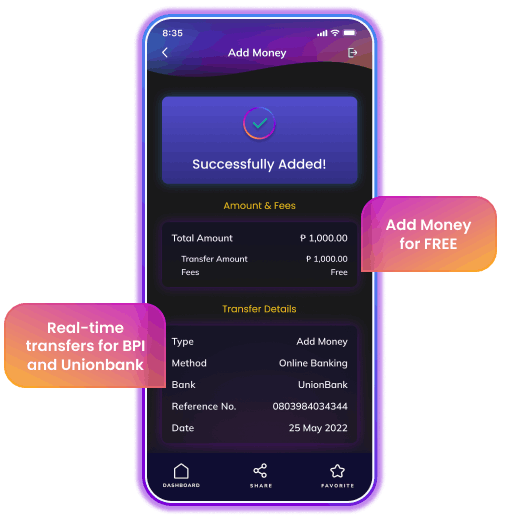

Cash in for free at 7,500+ outlets, cash out at 4,500+ outlets nationwide.

High interest

rates up to

6.50%

Personalize the way you manage your money and watch it grow with our high-rate savings and time deposit accounts!

Personalize the way you manage your money and watch it grow with our high-rate savings and time deposit accounts!

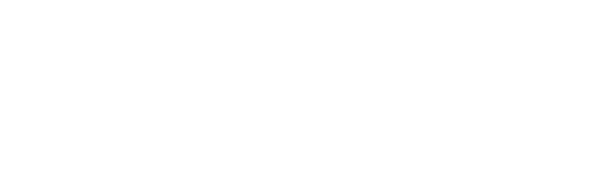

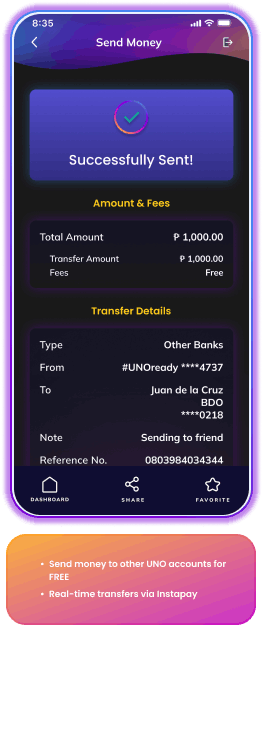

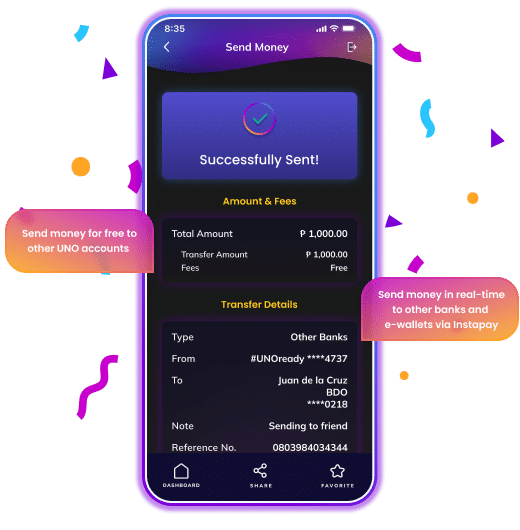

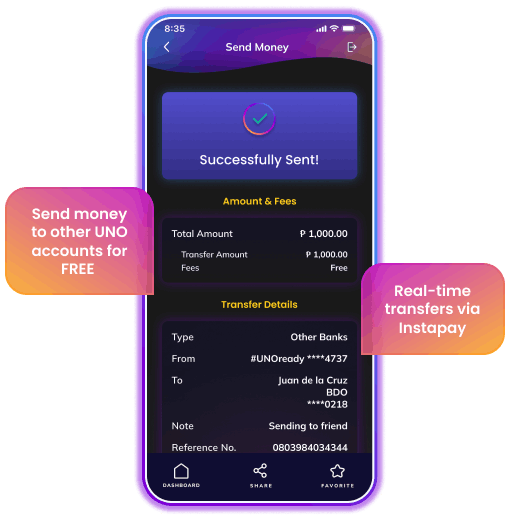

Free fund transfers

NO fund transfer fee when you activate your InstaPay!

Save money with our zero transfer fees when you send money to any bank OR e-wallet!

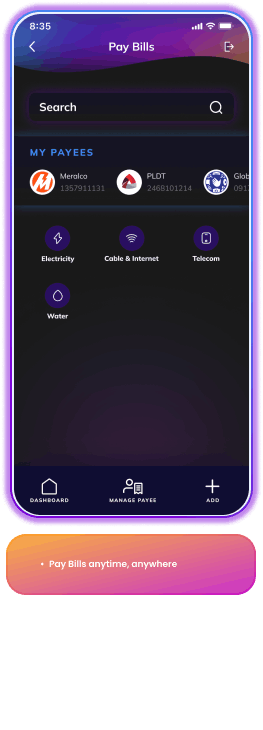

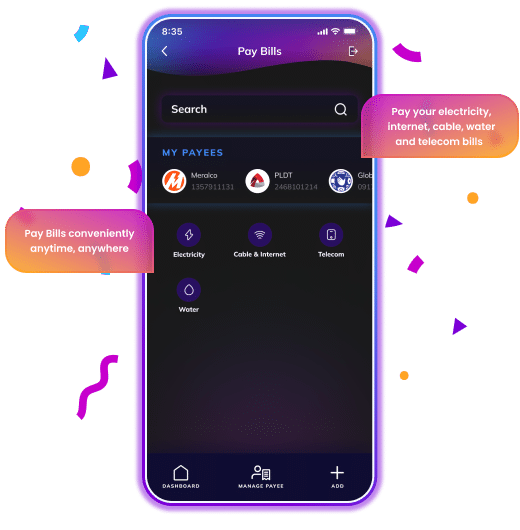

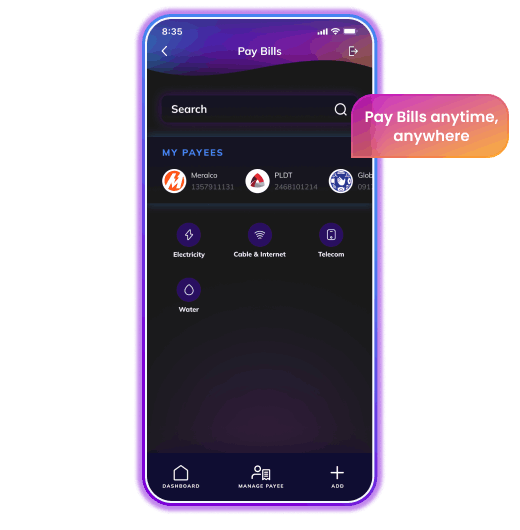

Pay Bills with UNO!

Easily settle your bills via the app and have your payments posted quickly with your #UNOready savings account!

Choose your UNO

Personalize your financial journey by choosing how you can grow your money with our savings account and time deposits!

#UNOready

SAVINGS

Take your savings to the next level with a 4.25% interest rate and free insurance!

#UNOboost

TIME DEPOSIT

Earn with an interest rate of up to 6.50% interest p.a. and experience a flexible choice of tenor.

#UNOnow

LOANS

Borrow as much as PHP 200,000 without providing collateral and guarantors! Plus, you can select from various monthly installment payment plans available.

Debit Mastercard

COMING SOON

Sustainable and eco-friendly. Our cards are manufactured from recyclable plastic!

...and more to come!

We’re just getting started.

We make sure your elevated banking experience is #SafeWithUNO.

Task Scams

Task scams are online scams that target individuals seeking job opportunities or looking to grow their income. Stay #SafeWithUNO and watch out for messages

Phishing SMS

UNO representatives will never ask for your sensitive information via SMS. Stay #SafeWithUNO by blocking unknown numbers that send messages like this! If

Job Scams

Legitimate employers will never ask you to pay fees for their job postings or offers. Stay #SafeWithUNO, and beware of any recruiter or company

BSP and PDIC

UNObank, Inc. is licensed and regulated by the Bangko Sentral ng Pilipinas (BSP). You may contact the Bangko Sentral Financial Consumer Protection Department through their contact number (02) 8708-7087 or email at consumeraffairs@bsp.gov.ph.

Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P500,000 per depositor.

BSP and PDIC

UNObank, Inc. is licensed and regulated by the Bangko Sentral ng Pilipinas (BSP). You may contact the Bangko Sentral Financial Consumer Protection Department through their contact number (02) 8708-7087 or email at consumeraffairs@bsp.gov.ph.

Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P500,000 per depositor.

Member of PDIC

Deposits up to PHP 500,000.00 are insured by the Philippine Deposit Insurance Corporation (PDIC).

Member of PDIC

Deposits up to PHP 500,000.00 are insured by the Philippine Deposit Insurance Corporation (PDIC).